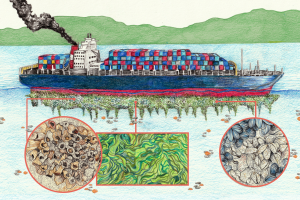

The shipping industry must invest in new vessels, fuels and infrastructure to achieve its 2050 climate goals, but there’s still a massive funding gap to 2030 and major uncertainty over regulation and technology.

International shipping is responsible for nearly 3% of global emissions. The International Maritime Organization (IMO), the UN body responsible for shipping, has set itself the target of reducing greenhouse gas emissions by at least 50% by 2050, compared to 2008 levels.

This is expected to cost international shipping $40bn a year by 2030 to produce zero-emission fuels and bunkering infrastructure, according to research by the University Maritime Advisory Services (UMAS), which is partnered with University College London’s (UCL) Energy Institute.

Between $1-1.9 trillion is required to decarbonise shipping fully. Of this, 87% will be needed to build land-based infrastructure and production facilities, primarily to generate hydrogen that can be used to produce ammonia, which is widely considered shipping’s future fuel.

Where is the funding coming from?

Banks and financiers are starting to invest in sustainable shipping but a large funding gap remains.

“There has been a lack of finance for shipping since the financial crash when traditional banks retreated from the market,” said Marie Fricaudet, a researcher at UCL Energy Institute.

Investors are wary of funding early-stage technologies or backing a zero-carbon fuel without clear regulations. Part of the problem is that there isn’t a consensus on which fuel will power shipping in future. Several options are on the table, but they all require different technologies and vessels.

As a shipowner, you are taking a risk…there is no true certaintyMarie Fricaudet, researcher at UCL Energy Institute

Ammonia, a compound of nitrogen and hydrogen that emits no CO2 when burned, is considered the best long-term option for container ships transporting cargo over long distances. But experts say safeguarding protocols need to be put in place first to address significant safety and environmental concerns.

Some companies, including Maersk, are betting on green methanol generated using renewable energy. Methanol is considered the better option in the short term because existing ships can be retrofitted to run on it. Ammonia, in contrast, must be stored under pressure or at extremely cold temperatures.

“The trade-off that anyone raising finance has now is: ‘Do I build a cheaper asset now with the anticipation of retrofitting it in five years’ time to ammonia or do I build a more expensive asset now, with that premium at risk because I might be betting on the wrong fuel?'”, said Tristan Smith, an expert in shipping at UCL Energy Institute.

“As a shipowner, you are taking a risk…there is no true certainty, including on the future mitigation policy,” said Fricaudet.

“What can you do as a ship owner when no one knows what the regulations are going to be in 10 years’ time?” said Maren Brandes, a lawyer at Watson Farley & Williams who specialises in advising international banks on ship finance matters.

Shipping is a fragmented industry involving many stakeholders: from banks and financiers to fuel providers, shipbuilders and insurers.

“You need a lot of things to line up to get a viable, investable project: a customer who’s going to pay a premium, you need to [find] a geographical location that has a sympathetic government and the right conditions for making green ammonia, and then the financier, insurer and owner with all the right open-mindedness to risk an opportunity,” said Smith.

Part of the funding for sustainable shipping “should come from public finance because it’s hard to expect private actors to take on all the risks,” said Fricaudet.

The European Union is leading the way in financing green shipping projects, said Nishatabbas Rehmatulla, a senior research fellow at UCL’s Energy Institute. Korea and Japan, two of the world’s biggest shipbuilders, are also putting some money into building vessels to run on zero-emission fuels, said Fricaudet.

As part of its “Fit for 55” package, the EU has invested €5.4 billion in sustainable and efficient transport, part of which will go towards green shipping initiatives, such as upgrading on-shore power supply at ports to help docked ships reduce their emissions.

The bloc has launched the FuelEU Maritime initiative, which aims to increase the uptake of low-carbon and renewable shipping fuels. But experts say it promotes the use of liquified natural gas (LNG), which is primarily composed of methane. Burning it should, in theory, result in lower greenhouse gas emissions than heavy fuel oil, but marine engines struggle to completely combust it, meaning methane, a more potent greenhouse gas than carbon dioxide, can escape unburned into the atmosphere.

The EU has spent more than $500 million on bunkering infrastructure for LNG ships.

Most public and private investment is currently going to ships running on LNG. “There has been a huge uptake [of LNG]. Many shipowners are putting their earnings into LNG ships, and a lot of banks are giving loans to LNG [projects],” said Fricaudet. “But it’s not a zero-carbon option. Those ships will become stranded assets because using LNG as a marine fuel is not compatible with the decarbonisation of the shipping industry.”

The global fleet running on LNG risks financial losses of US$850 billion by 2030, according to a study carried out by Fricaudet and other researchers at UCL. The full value of this risk would not be realised if the LNG-fuelled vessels were retrofitted to run on zero-emissions fuels, such as ammonia, the analysis concluded. In this scenario, the financial loss is estimated at around 15-25% of the vessels’ value, between $129-$210 billion.

Aligning finance with climate targets

The alignment of climate targets within shipping finance is enshrined in the Poseidon Principles, launched in 2019. They establish a global framework for financial institutions to monitor and assess whether their shipping investments align with IMO targets. Currently, 30 banks and 17 marine insurers are signatories. They are required to calculate vessels’ carbon intensity and disclose it in their portfolios.

“It’s a transparency tool and information is key,” said Brandes. “It will enable the lender not only to [see] themselves what their final portfolio looks like but also to take a view on what they are willing to invest in going forward.”

“The impact is not immediate, but it will change the market,” she added.

But the principles don’t require ship owners to reduce their emissions. “It’s a commitment to report, not to reduce anything,” said Rehmatulla.

The focus is on disclosing CO2 emissions, rather than all greenhouse gas emissions, including methane, which means that “LNG [ships] score well so far in comparison to other ships,” said Fricaudet.

But the financing rules may become more stringent in coming years. Marine insurers are pushing for the Poseidon Principles to adopt a net zero by 2050 target.

The head of the Poseidon Principles said last month that they would adopt an emissions reduction trajectory in line with net zero as soon as the IMO sets this long-term goal.

“The urgency is clear. Because of the role that shipping plays in the global economy, we must accelerate our ambition towards the Paris Agreement’s 1.5C temperature goal,” Michael Parker, chair of the Poseidon Principles for Financial Institutions, told the Global Maritime Forum at a briefing session.

“This new ambition will allow the Poseidon Principles to continue playing our role in incentivising and supporting the decarbonisation of shipping,” said Parker.

This highlights that IMO regulations and internationally agreed emissions targets will be the driving force behind finance for sustainable shipping, experts say.

“Because financing happens on such an individual basis, I don’t think that the way you direct funding will be a game-changer,” said Brandes. “It has to come through regulations.”

“A strong signal from the IMO is all we need at this point,” said Rehmatulla. “If the IMO says in the next round ‘we are now aiming for 100% decarbonisation by 2050’, that in itself would have a significant impact on how the sector then proceeds…at the moment the 50% target is still giving people some wiggle room.”

But a standalone long-term target isn’t sufficient to drive change, said Smith.

“The thing that really changes aligning shipping towards 1.5C for me is not the 2050 target but the 2040 target, in combination with the 2030 goal,” he said, noting that to be aligned with keeping warming well below 1.5C, the world needs to halve its emissions by 2030.

“The reality is that we will overshoot the 2030 target, and then we’ll need to do 90% or 95% reductions by 2040,” said Smith. The IMO’s current short-term measures, which focus on reducing ships’ carbon intensity and improving efficiency, are “grossly misaligned” with what is needed to achieve the long-term goal, said Rehmatulla.

Including maritime emissions under the European Union’s emissions trading scheme (ETS) from 2023 could also be a “huge game-changer,” said Brandes.

When the measure comes into force, shipowners, regardless of the flag they fly, will have to buy carbon allowances to cover all emissions during voyages in the EU and half of those generated by international voyages that start or finish at an EU port.

“The ETS would have a real financial impact with a penalty that is €110 per tonne of CO2 or higher, and with a price of carbon that is €90 per tonne of CO2 or higher, especially for longer voyages if from 2028 non-EU emissions are included,” said Brandes.